In Tally.ERP 9 Release 5.0 and later versions, recording inclusive-of-tax transaction is simplified. Earlier you had to create a voucher class with inclusive-of-tax percentages to record inclusive-of-tax transactions. Now, this can be done by enabling the option Allow entry of rate inclusive of tax for stock item? under F12: Configure in sales or purchase invoice.

To record an inclusive-of-tax transaction

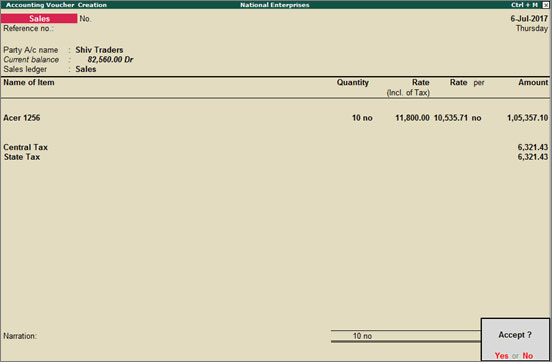

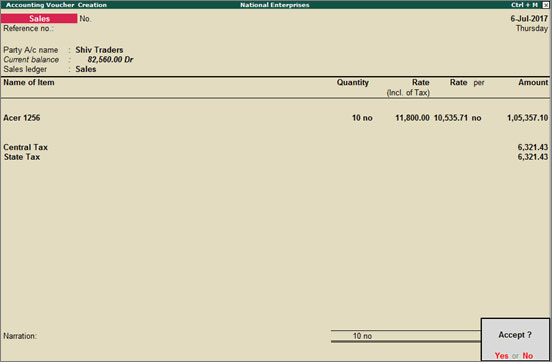

1. Go to Gateway of Tally > Accounting Vouchers > F8: Sales

2. Click F12: Configure and enable the option Allow entry of rate inclusive of tax for stock item?

The column Rate (Incl. of Tax) appears in the invoice.

Rate (incl. of Tax): Enter the rate of the item including tax in this column. The actual rate will appear in the Rate column . The tax amount will appear automatically on selecting the tax ledgers.